For the past couple of days, the internet has been set ablaze by the story of a bunch of nerds in their basement giving Wall Street sharks a taste of their own medicine. You may be confused and wonder: What the hell is going on?

Glad you asked! Let’s explain how this fascinating story is unfolding, and why it is about to become a legend of the financial market told with awe and wonder decades from now.

A month ago…

It all started with a struggling video game retailer: Gamestop. In the age of dematerialisation and cloud gaming, in the middle of a pandemic, trying to sell physical copies of videogames in a store was a tough proposition.

Like blood in the water, the woes of Gamestop attracted numerous financial sharks: hedge funds that started to pile short positions against Gamestop.

Wait, slow down, short positions?

A short is a financial tool which basically comes down to a person, John, borrowing a share from someone else, James, and directly selling it to a third person. John is betting that the stock will fall, and that he will be able to buy a new share at a lower price in the future, pocketing the difference. However, if the stock appreciates, then John will have to buy a share higher than he sold it to give it back to James. In the meantime, John will pay interests to James based on the current value of the share he borrowed.

Hedge funds, betting that Gamestop would go bankrupt, accumulated A LOT of shorts against it — a whopping 139% of the stock, making it the most shorted stock in the world. This means that for every 100 existing shares of the stock, 139 were borrowed, a very dangerous situation.

Enter the hero of our story: /u/DeepFuckingValue

Now the short positions against Gamestop put a lot of pressure on its stock, but some saw that the short sharks may have overplayed their hand by accumulating so much shorts at once, and started betting against them. In particular, one guy, known online as DeepFuckingValue, bet $50k in September 2019 that the Gamestop stock would rally. He then went on the WallStreetBets subreddit (a forum-style social media), and started convincing other small investors to bet against the hedge funds.

On January 12th, 2021, his efforts finally paid off, and enough people had joined him to trigger a “Short Squeeze”: the stock started to gain a lot of value, going from $5 to $30 a share, some short hedge funds started to panic as they were facing a lot of losses if they had to buy back share at such a high valuation, and they tried to close their positions. However, the number of shorts was so high compared to the number of available shares that not everyone could get theirs back at a decent price, triggering panic and a spike in the share price.

Usually, a short squeeze is a rare, but brief moment, during which people who are short lose a lot of money, the people squeezing gain a lot of money, and then the stock comes back to a more reasonnable level. However, this was counting without the stubbornness of the army of redditors behind DeepFuckingValue.

The art of not making money

The goal of the redditors may have been initially to make a bunch of money, but now they knew that they had the hedge funds by the balls, and they did not intend to let go. In particular, one of the hedge funds, called Melvin Capital Management, had concentrated their wrath, and /r/WallStreetBets did not want to just extract some money from Melvin — They wanted to see it burn down. Instead of selling their shares for some 6x return, they collectively started to pump themselves up not to let go of anything.

Suddenly, the blood in the water was coming from the hedge funds that had short positions against Gamestop, and that attracted other sharks, feeling the opportunity of a lifetime. The market went into a frenzy and the Gamestop stock continued to spike, trading yesterday at over $300 a share (over 100% more than the day before), for a total capitalisation of over $20 billions, 50 times more than it was just a couple of months ago.

When will this stop?

That’s the now multi-billions dollar question. The movement on Reddit has turned into a modern day Occupy Wall Street, and while people do like some money, they enjoy even more seeing the people responsible for the 2008 crisis finally punished after having been saved by governments and public money when their degenerate bets failed. Shorts are currently holding their breath, waiting for the bubble to pop as there is most likely no way they can buy the shares they need at the current valuation without going bankrupt, but in the meantime, they are bleeding money in interests, and redditors have no intention to let go before Melvin has drown. The Gamestop stock is currently a pure bubble, and it will crash back down at some point, but the bubble holding for so long and continuing to grow defy all common knowledge about financial markets.

And that scares the shit out of a lot of people.

All hell breaks loose

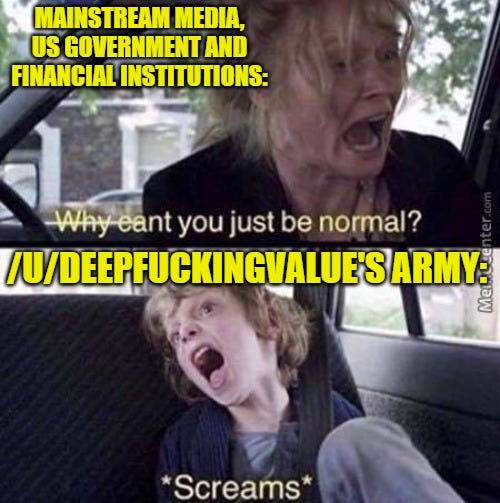

At this point, even Michael Burry, the financial genius that inspired the movie “The Big Short” is calling what is happening unnatural, insane and dangerous, despite having bet on Gamestop for a while now and having made what must be an incredible amount of money thanks to the current mania. The White House is monitoring the situation. The Nasdaq CEO suggested halting trading to allow hedge funds to “recalibrate their position”.

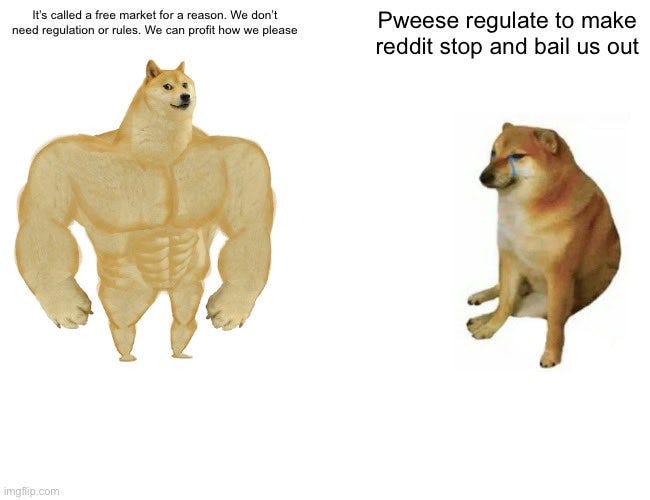

The irony of hedge funds, who have invented the most perverse financial tools to bend financial markets around regulation, now calling for overview of a bunch of teenagers organising through a public forum is not lost on anyone:

Hedge funds last week: This week:

More worryingly, some very shadowy attempts of manipulating the market are taking place at the moment. Discord, a chat tool used to animate the community of the WallStreetBets subreddit, shut down the WallStreetBets forum after trading hours yesterday over charges of hate speech — charges that you could make about virtually any community that had grown as much as the subreddit had grown in the past two weeks. Given the timing of this ban, this is widely interpreted as an attempt to silence the WallStreetBets community.

CNBC reported yesterday that Melvin closed their short position, a claim that has yet to be confirmed and some suspect to be a blatant lie told in an attempt to appease the crowd of redditors, which would constitute market manipulation.

Worst of all, Robinhood, an app that spent 7 years building a reputation of being on the side of the small investors teaming up against big Finance and which is massively used by millenials and zoomers, stopped this morning its users from being able to buy any more share in Gamestop. Many thought initially that this was linked to their relation to Citadel, a hedge fund that invested over 2 billion dollars in Melvin to bail them out earlier last year, and which is also responsible for 40% of the traffic Robinhood see every day. It seems that the issue was instead linked to obscure regulations, and that the main issue was the absence of communication from Robinhood about the move. Nevertheless, given that over half of Robinhood users possess shares in Gamestop at this point and that it created a heavy downward pressure on the stock, it will likely open them up to a gigantic class action lawsuit from its users, while also torching to the ground the reputation they took 7 years to build.

The blatant injustice of it all really defines the moment and is being called out by a wide range of personnalities:

Redditors on /r/WallStreetBets are filled with a righteous fury by each successive blow from mainstream institutions, strengthening their resolve to see Melvin bankrupted. Meme Lord Elon Musk could of course not pass the opportunity to put fuel on that fire. Billionaire investor Chamath Palihapitiya invested a few $100k for the lulz and will donate the gain he made to a charity.

This is without a doubt the craziest financial story we have had the chance to witness in our lifetime, and I am so looking forward to watching Christian Bale play DeepFuckingValue in the Hollywood adaptation of the best seller Michael Lewis will write on the topic.

Okay so… Should I buy Gamestop shares?

Not if you would lose sleep seeing it vanish! This is a textbook bubble, and while there is no telling how high the stock will go before crashing down, crashing down it will. When that happens, a lot of people will lose their shirt (including, if WallStreetBets get their wishes, the entirety of Melvin).

For now though, /r/WallStreetBets is full of heartwarming Robin Hood stories of people taking money from Melvin in order to pay Lymes treatment for their sisters.

If you want to understand more about the financial aspect of bubbles in general, and this one in particular, you should really check out Noah Smith’s newsletter!

And in the meantime, grab some popcorn, relax, and enjoy watching a bunch of Reddit shitposters beat the crap out of some Wall Street sharks at their own game.

If you enjoyed reading this essay but haven’t subscribed yet, join our community of curious folks and meme lovers by subscribing here!

You can also join the conversation and send me a message by responding in the comment section below. I would love to hear your feedback!